Your heart sinks. You have some place to be. Some place important. Probably an appointment. And you are on the cusp of almost running late. And then… brake lights. Miles of bright red lights. Oh no. Not now. Please not now. I don’t have time for this.

And so it goes. Because traffic will absolutely pile up at the most inopportune time. Caused probably by a wreck. A breakdown on the side of the road. Or some unseen, phantom force. Or, more likely, a group of forces colluding to make your life miserable and you late.

In central Texas, with the mass influx of people over the years, and especially for those of us living in what were previously quiet, exurban communities now turned booming suburbs, the constant stop and go of traffic jams have become more and more of a problem. And, dear reader, after having been caught in yet another snarl on what used to be a sleepy country road, it hit me: our real estate markets are caught in a nasty stop and go traffic jam of their own. And like a traffic jam, it will probably take a long time for it all to play out.

News from the front

Whenever I have an opportunity to speak with another real estate pro, I try to ask what they are seeing on the front lines. There is a theme these days: listings are stacking up heading into the busy season. There is anxiety over exactly where the buyers for those listings will come from. The smart agents are trying their damnedest to temper the unreasonable expectations of 2021-2022. But it is a slog. The crazy thing about unreasonable expectations is they form rather quickly and leave very slowly.

For those who don’t live and breathe real estate market every day, it may as well still be 2021. I know. I query non-real estate professionals as often as I can safely work it into the conversation. At track meets and after church. At Super Bowl parties and family get-togethers. What I found in these interactions is that most people only care about the state of the real estate market when it is time to buy or sell. The rest of the population, who are not actively in the market, appear to be asleep in the back seat of car and clueless that we are stuck in traffic.

Of course, relatively speaking, the state of our markets are slowing but still higher than in 2019. People selling today are still making a killing if they bought previous to 2020. Just not as much of a killing as if they sold in March of 2022. It’s like we were speeding down the road at 100mph but now are only going 85mph. For Us, Humans, usually stuck in the here and now, this dramatic slowdown is considered a terrible inconvenience. And, humans being humans, the sudden change is what they care most about. As a species, we tend to lack big picture perspective. So battling expectations seems to be the common thread of the day.

Interest rates are the brakes and the gas

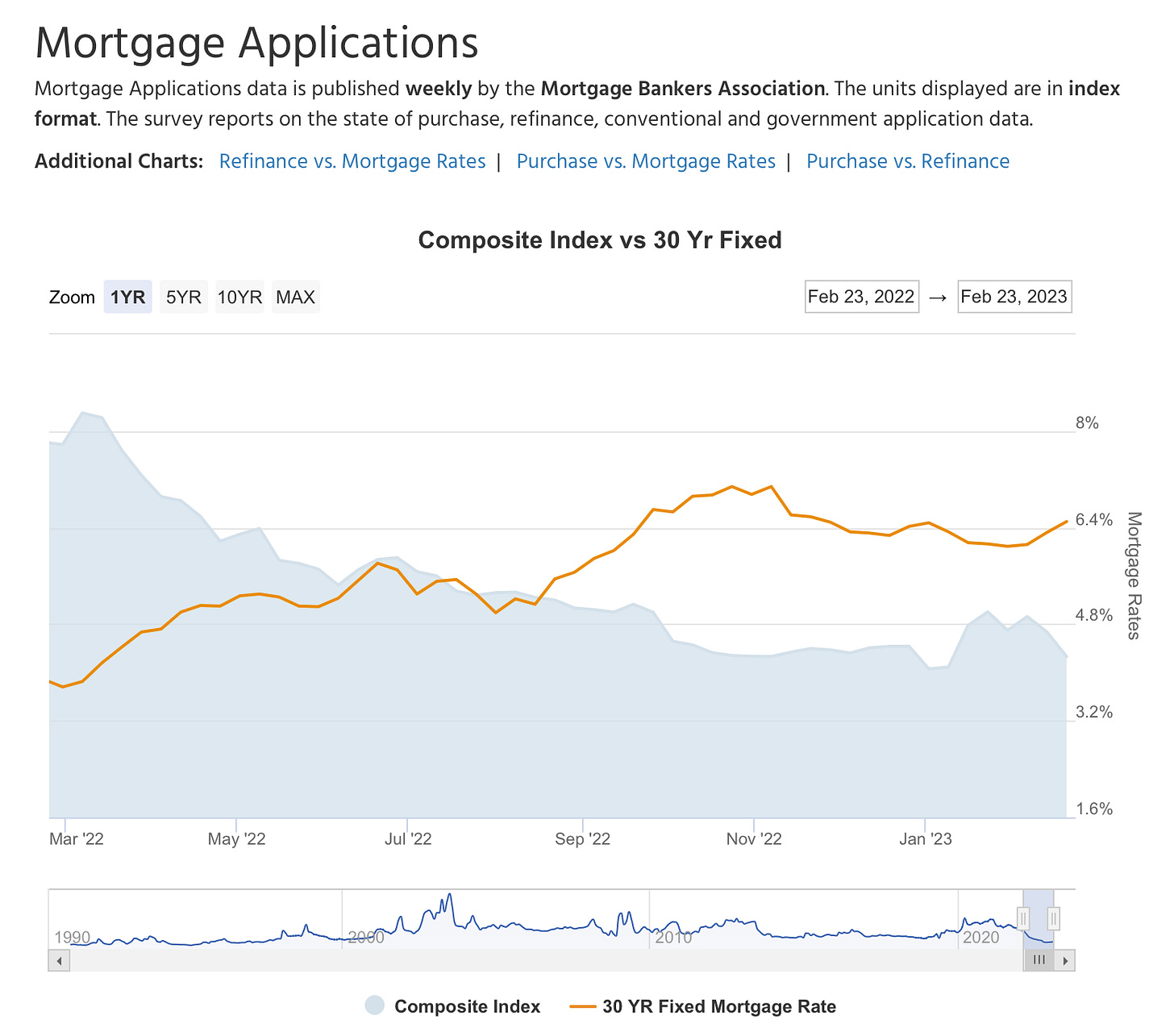

On the off chance you were not aware, dear reader, real estate is interest rate sensitive. If it pleases the court, I submit as evidence the mortgage interest rate-mortgage application inverse relationship (see chart below). After peaking in November, rates started to ease down into December of last year. Mortgage applications subsequently bumped up. Now rates are back on the rise again and applications are nudging down. So there is a very obvious, ver causal relationship.

Which is why nerds like me obsess over Uncle Jerome “Jay” Powell at the Fed. Because his diktat of short term rates heavily influences (not directly, dear reader, but indirectly) the benchmark 10-year US Treasury Note upon which most other rates, including mortgage rates, are based. And Uncle Jerome is now stuck in that terrible interest rate traffic jam created by his ownself combined with the precedents set by all of his predecessors. He taps the gas and then the brakes. Gas then brakes. Gas then brakes. Stop and go. Stop. AND. GO!

Creative financing

Loan originators need to eat too. And to eat they need to make loans. But with the doubling of mortgage rates in the past year, the market has boxed out a significant portion of potential and otherwise willing buyers. Creative financing to the rescue. I am seeing an increase in emails from lenders and originators advertising loan products to get the otherwise ineligible buyer back into the market. One email advertised a no down payment mortgage product. Said email outlined a mortgage with a 101.5% loan to value with a maximum 50% debt-to-income ratio. The minimum FICO score for this product is 620. Guys… yikes!

After over a decade of government service, I can say for sure and for certain that where there is a rule, there is a way around it. There are nothing quite like ‘free’ markets to generate a solution around regulation. So here we go again it seems. Of course, I look back to the loosey-goosey lending of the mid-2000’s (80/20 loans, no-doc loans, etc) and the subsequent disaster those loan products created as a frame of reference. And we all know how that went.

Folks, where there is a will, there is a way. In my experience a vast majority of the population is financially unsophisticated. If a house is the object of the heart’s desire and if a buyer can pass the mortgage underwriter’s scrupulous screening, then loan documents they will sign. Long term consequences be damned. And if the falling standards of police recruiting over the past few years are any indication, then standards will fall where needs fall short in the mortgage arena too.

Very Important Aside: I do NOT cast blame on the street-level mortgage originator. I work with many great originators who exist within a system to try and meet needs and solve problems. People want houses. To buy a house, they need a mortgage. An originator will help you with this. This is how it works now. So, no, dear reader, cast no stones at the humble originator. All of this is not their fault.

In fact, the mortgage originator is a product of our collateralized market and economy. They are a product of the mortgage backed security - that big, hungry, devouring whale that has consumed us all and desperately needs new mortgages to consume. And we will feed it. Oh yes we will. We will sacrifice many upon the alter to sate our new and hungry god. Dear reader, the MBS monster is a beast of our own making. We were so happy with it when times were grand. What can we say when it turns against again?

Failure a lesson to teach too

Real estate types (especially that merry group of eternal optimists called Realtors) tend to always be grasping at the success story. We love to hear the tales of those who made it, how they made it, and what they suggest we do to make it too. Success stories are like crack for the Realtor soul. Also the starry-eyed buyer thinking only of the bright side. But, dear reader, failure has a lesson to teach too.

I’ve fought this battle before. Being a Cassandra, I am always looking for how a deal is going to blow up in my face. And that is my approach to most real estate deals: how could this thing kill me? And I tell people that there is a gremlin hiding behind every wall: you don’t even have to know exactly which gremlin. But the Wise Investor must acknowledge and embrace the gremlin’s existence. Be ready to meet the gremlin. And only then are you truly prepared to buy real estate. Oh, but telling the heartsick lover of the pitfalls of puppy love is a fool’s errand. At best, your advice is politely ignored. At worst you are the recipient of scoff and disdain. Cassandras are rarely the most popular person at the party (unless, that is, it is a party of Cassandras).

One of my favorite things to do when driving through the Texas hill country is to play again the The Path to Power, the excellent book written by Robert Caro (and beautifully narrated by Grover Gardner) about Lyndon B. Johnson’s family history and childhood. Caro paints a picture of the hill country that is stark, occasionally bleak, gritty, and poignant. Very poignant. One leaves the chapters with the smell of droughty juniper in the nose and the calcium taste of heavy limestone water in the mouth. And the lesson Caro teaches about real estate comes from the rise and fall of LBJ’s father, Sam Ealy Johnson. Ole Sam made his fortune in real estate. But one bad deal in a falling market cost him everything. The story is harrowing for a Dirt lover like me. And it is a warning too: reaching too far can ruin everything. Especially in a falling market. Dear reader, seek out the stories of failure. In my opinion (and life experience) failure is more instructive than success. Seek out those who lost. Know their stories too. Alas, we are too often seduced by the glamorous win.

What it all means for real estate

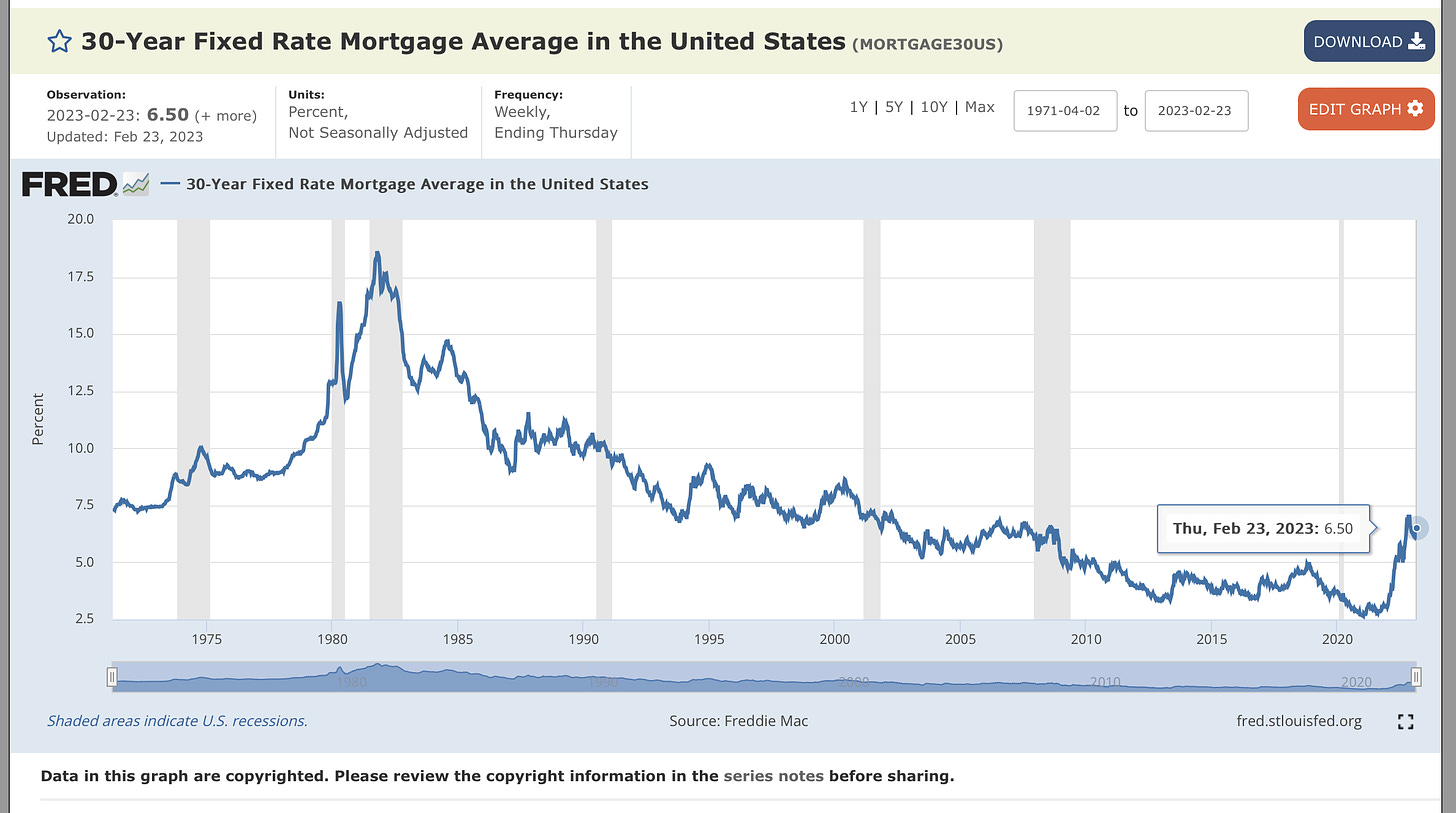

Financial historians, looking back over the last 30 years, note that asset prices (including real estate) have largely been bolstered by a continuous fall in interest rates. If one buys this line of reasoning (and it is very seductive logic), then many of those who think themselves great investors today quite possibly have just been extremely lucky in time and circumstance. But what if things just go sideways from here?

I’ve noted before that I think there might be a glass ceiling to how high interest rates can go (based on the realities of the current federal deficit and of government funding and interest payments). Extending a bit of linear logic from there (and we all know how dangerous linear thinking can be so take this with a large grain of salt), if there is indeed a glass ceiling for rates at about 6% and a floor of zero percent, and if real estate prices are highly correlated to interest rates (I’ll go ahead and assume causation here) then prices have little room to go but sideways for the foreseeable future. But with a lot of ups and downs in between. Like a sine wave. Or the stop and go of a traffic jam.

So stop and go. Speed up and brake. Whiplash. Fender benders. Aggravation. And go ahead and call it in, folks. Because all those brake lights mean that you are probably going to be late to that appointment.

Coda: the curve must revert

For the past few weeks, I’ve been doing my best Cato the Younger impression and ending my essays with the stark reminder that the interest rate yield curve must revert. Which is to say, the day will come when short term rates will once again be LESS THAN long term rates; e.g. the 1-year US Note currently hovers around 5% which is GREATER THAN the 10-year note which is currently a hair under 4%. If money has a decreasing value over time (inflation) then this inverted relationship makes No Cents (see what I did there?)

Historically, when the curve inverts deeply, it denotes a very unhealthy economy with what I assume to be completely unrealistic expectations about time and money. A yield curve inversion (in the chart below an inversion appears when the blue squiggle dips below the solid black line) has preceded each of the last five recessions. And we are now deeply, deeply inverted. Of course, it is not the inverted curve that kills but the reversion that really shows when you are in for it. And there is no saying how long this can last. It is all up in the air. I suspect though, that we will be required to hit the brakes hard when we do catch up to the traffic jam. And the stop could be violent. So buckle up, friends, and be ready for a wild, nauseating, and frustrating stop and go ride. We might all find that we are gonna be a little late, or maybe very late, to the party. It all depends on the traffic.

Share this post