Seven little words. One very big question: Is now a good time to sell? I imagine that I will address this question again (and again and again) in The Future because there are so many facets to the question. Also because it is always coming up. And because the answer is constantly changing. For this particular essay, I am going to examine the question from a purely hard-nosed, mathematical, hard-core-finance point of view. Yes, Dear Reader, we will look at the question from the point of view of the mythical Wise Investor.

Before we go further, please note that I do NOT consider myself the Wise Investor. No, I consider myself an enthusiastic student. However I am blessed to know several wise investors both personally and through authorship (I read their books). The credit for whatever wisdom my words might hold goes entirely to them. Now onto the question.

Is now a good time to sell - the WRONG way of looking at it

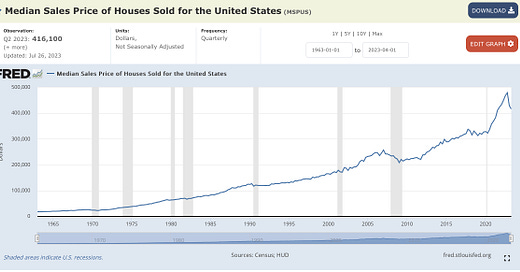

Is now a good time to sell? First we will look at the question the WRONG way. Which is the commonly implied way of comparing today’s price to yesterday’s price and to a future price. Here’s a chart to help us:

Now I am a Farm and Ranch guy who specializes in rural and acreage properties and this chart is for housing. But price trends of rural, acreage properties track the housing market pretty well so this is a good enough proxy to make the point. And the point is this: looking back to the very recent future, the current real estate market is down about 10% in the Austin MSA. From that angle, today is NOT a good time to sell.

BUT! Dear reader, look harder at the chart, today’s price is still better than any other price prior to 2020. So unless you bought your property after 2021, if you sell today then you are very probably still making a handsome and tidy profit. From that point of view today is still a great time to sell. Sadly, this perspective is often missing in our mental calculations. And that is because most humans suffer from the habit of Recency Bias - which is the tendency to prioritize recent events over past events. Very few of us have the long-term price charts memorized. Most of us can only recall back to the highs of early 2022 and sigh.

It doesn’t matter…

Oh but here’s the rub: it doesn’t matter. All of that information is in the past. It is water under the bridge. The train has left the station. The only prices that matter are 1. the price that we know in today’s market and 2. the price that we might GUESS in a future market. The following is a very useful chart of what might happen in the future:

Now I am sure that you, Dear Reader, have a guess of what real estate prices will do in the future (if you are reading this then it is likely that you are Dirty and Nerdy like me and have opinions on the matter). And that guess is loaded with what you know, what you think you know that ain’t so, your emotional baggage (we ALL carry it!), and a bunch of other stuff. All of these inform the way we view The Future. The problem is that none of us knows for sure what the future holds. It is all a GUESS! So when most people ask the question ‘Is now a good time to sell?’, most people are trying to make a decision today based on prices in the past and a guess about prices in the future. It is also known as timing the market which the Wise Investor knows is a fool’s errand little better than gambling. So how would the Wise Investor frame the decision?

Trade-offs and Opportunity Costs

An armchair economist (such as Your Humble Author) is wont to say things like: there are no choices in life, only trade-offs. By which I mean that, in a world of limited resources, choosing one option necessarily means you choose against several other options. For example, if I choose to sell a property that I means I trade that property for cash. And it is important to know that the Wise Investor looks at the transaction precisely so - as a trade of one asset for another. And when that trade is made, the Wise Investor understands that they are trading the benefits of land (future appreciation, income, farming, hunting, camping, enjoyment, etc) for the benefits of cash. Which brings us to our main point: is now a good time to sell when one considers the present benefits of cash?

What can you do with cash?

First, you can consume it. Well, not with salt and butter but you can trade that cash for things you want that will not bear a future return. Perhaps on something like an around-the-world cruise. I’d say for the right person that is a perfectly reasonable way to dispose of cash. As long as that person understands and acknowledges that once the cash runs out, all you will have left are the memories and experiences it afforded you. That is one type of trade.

Second, you can invest it. Which is to say that you can trade that cash again for another asset. Perhaps stocks. Perhaps bonds. Perhaps you can use the amazingly favorable tax laws of the 1031 exchange and trade again into a different property - perhaps one with better income or long term appreciation potential (the Wise Investor’s favorite move!). These are other options. However, today we are going to assume that we are very uncertain about the future, will remain very conservative, and want to be as liquid as possible. That recipe calls for trading the land for cash, paying the necessary taxes, and then trading again into short-term, 30-day T-bills yielding a very handsome 5.5% (as of this writing).

Now here is where some guessing comes back in - remember that participating in the market requires a bit of educated guessing. If you presume, like I do, that the facts of today’s economic and market environments make short term appreciation of real estate very unlikely then the above trade of land for cash and then cash for short term T-bills is an attractive option. Further, if you are one of those who is concerned that the stage is set for a very nasty depreciation in the coming years then the above trade is a very attractive option (depreciation means assets decrease in price and the dollar increases in purchasing power). Finally, if you are one of those hard-core, savvy real estate investors who is waiting for the right opportunity to pounce if the market turns then selling today is a fantastic option. BUT! If you are none of those types, if you guess the opposite about the future, OR if you, like me, believe that land in Central Texas is an incredible LONG TERM (over 10 years) investment, then now is NOT a good time to sell.

To summarize (the Down and Dirty): the Wise Investor looks at the sell decision in terms of a range of alternate decisions (trade-offs) and not merely in terms of today’s price compared to past and future prices. So if there is a more attractive investment opportunity than land in today’s market then the decision to sell is made based on that. Right now, at this very second, real estate prices are trending downward while very liquid T-bills are yielding 5%. That old, hard-nosed Wise Investor probably thinks that this is a pretty danged good trade all else considered.

All else considered

BUT! All that written, remember that making that trade forgoes many other options. The first of which is the right to the future benefit of the property in question. And that is where the actions of the mythical Wise Investor diverge from most of us. Because there are often (always?) emotional strings attached to a decision to sell a piece of property. There are also a range of other considerations that make the decision to sell even more complicated (e.g. estate planning, paying capital gains tax, etc). But those, Dear Reader, are a topic for another day.