Howdy y’all. Well it’s already February (where does the time go?) and therefore time to take a step back and see what happened to the price of our Texas Dirt in January. First, I remind all of you lovely people that all of this is very Dirty Data and for entertainment purposes only. Please, for the love of Texas, do not base large financial decisions on any of this. This is, however, great conversation fodder and a starting point for deeper discussion.

State price trends

The following chart represents listing1 prices per acre by year for the entire state of Texas since 2011. One can certainly see the nasty little bubble that formed starting in 2021. Evidence shows that we are coming down from a November 2022 top with about a 3% decrease from December. If you subscribe to the idea that land lags residential by about 6 months then this makes sense.

The question now is: how low can she go? Will we revert all the way back to the pre-2021 trend? That would be a 38% drop. Gnarly. BUT! I think that would require a great deal of distress, and I see no evidence of that on the horizon. A return to January 2022 levels would be about a 15% drop. Still gnarly. But that figure doesn’t seem as… catastrophic. Would I personally be very excited about taking a 90% LTV note on a hunk of burnin’ Texas Dirt at the present time? Ummm… no.

Barring any big southward (lower) interest rate moves, I expect statewide price per acre averages to continue their downward trend and plunge below the Trailing Twelve Month (TTM) line in the next month or two. That is a 2.5% drop. After that it’s all guesses and conjecture. Of course Texas is a big state, and there will be A LOT of variance in price action by individual county. I expect those properties closest to our major metro areas (and which experienced the greatest price increases) to experience the biggest corrections (in dollar terms - not percent). Property type and location will also make a big difference - I expect producing ag land owned outright in the Panhandle (or even with a very modest note taken back in the good old days) to be just fine. The 50-acre gentlemen’s ranch outside of Austin owned by a recently laid-off Amazon exec might see some aggressive price moves - the retiring Houston oil exec might be a buyer. Large and dramatic price moves will be decided by degrees of future economic distress. To that end, in this kooky economy, one can only speculate and wait and see.

I also make plenty of allowance in my heart for being surprised as to how little of a price drop there might end up being at all. As an economy Texas has strong fundamentals, and I think there might be enough factors out there to support a pretty high floor/ bottom. In that vein, I am interested to see how the global energy crisis continues into 2023 and possibly supports (or not?) land prices in oil and gas producing counties - the Houston metro is looking healthy in the month-over-month price change map further below.

Month-over-month changes

Month-over-month price changes are negative throughout most counties.

But we are still well over January 2022 listing prices…

Year-over-year changes

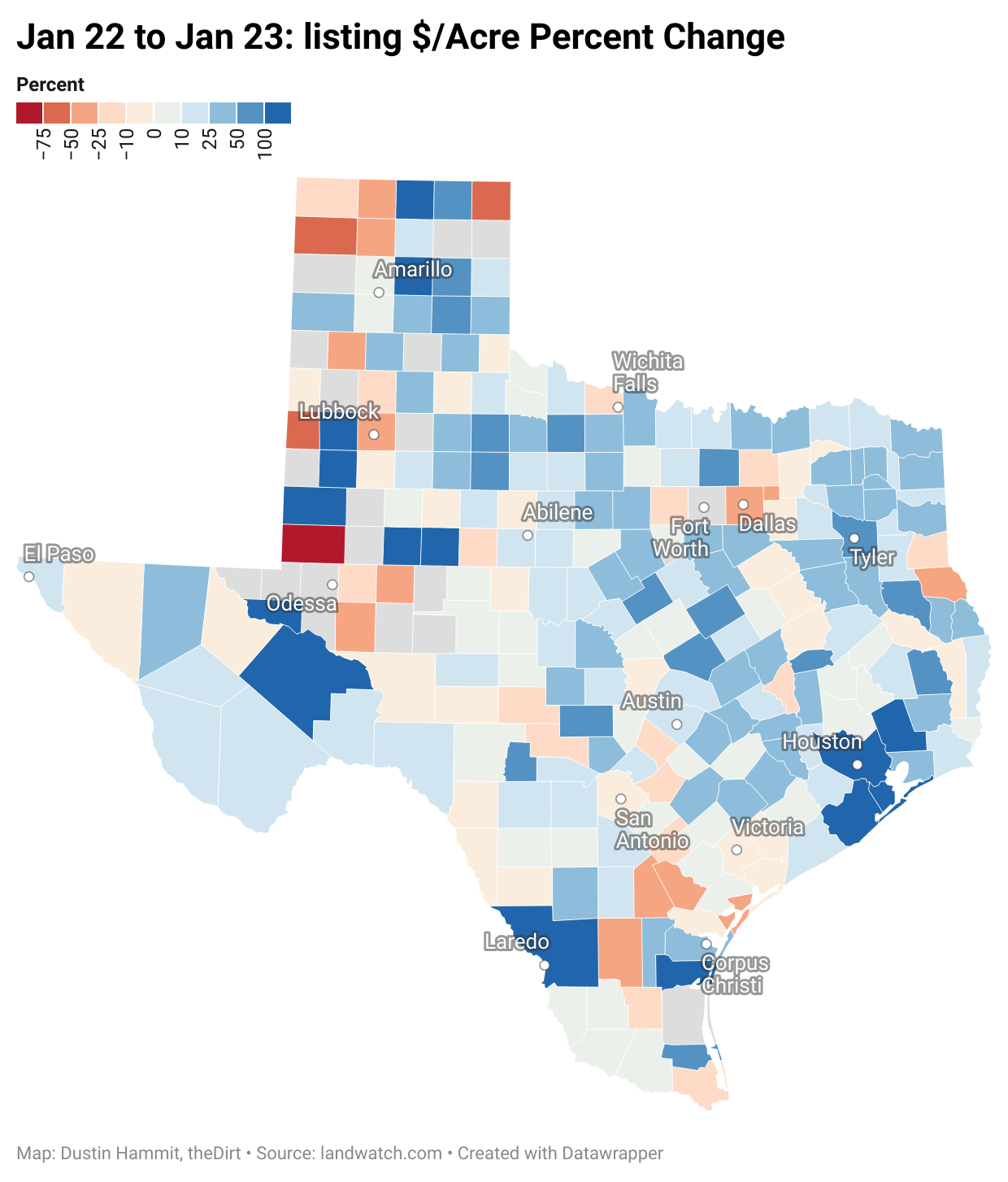

As far as year-over-year price changes, the map is still mostly blue although more pink is starting to show through. This map will likely trend pink over the next few months. For context, compare it to the price trends chart further below.

Context and commentary: the year of our Lord 2022 was one helluva year for acreage properties.

Well that’s it for January. Of course I am always interested to know all the ways in which my data is (or I am) wrong. Please leave a comment and poke me in the eye. Let me know what you are seeing out there. Or, if you are in the mood, say something nice. That is cool too.

These are listing prices - sticker prices - not actual final sales prices.

Well, you are always wrong except in this instance. Agree that it’s going to take some significant job losses to see cuts in land and housing. The market clearly doesn’t care what the fed does with rates, which is mind blowing to me. Time will tell if the rate hikes will continue to have an effect.