theDirt Weekly: November 19, 2022

Man yells at chickens and other delightful stories

Down and Dirty this week

Yelling at chickens · Dallas Fed tells it like it is · The real economy versus the just plain silly · Carthago delenda est · NAHB sentiment and the sound of toilets flushing · Just a bit outside: a story of stray missiles and the end of the world · What it means for real estate?

Yelling at chickens

Yelling at chickens is a fruitless endeavor. At best they will squawk and flap and run around in circles. Then, once the yelling is done, it is back to their same old chicken behavior. Sometimes they won’t even do that. If your yelling is from a distance or not accompanied by running and sufficient waving of arms then those chickens will just stare at you with their dumb, blank chicken stares until you are done yelling. Then they will poop. Then it is back to whatever they were doing before. Very frustrating for the yeller.

Perhaps there is a lesson here. When it comes to the news, perhaps I should be more like a chicken. Maybe we all should.

Dallas Fed tells it like it is (which is encouraging)

Astounded. That’s what I am. After spending hours and hours looking at properties across the state this past week, I am still in awe at how much has changed in only a couple of years. Even though I lived through it. Even though I watched as it happened and was floored as it was happening. Still, I am astounded at the incredible velocity and heights to which prices of real estate climbed. I sold a house in 2017 and could not believe the profit. I thought real estate was frothy then. I wondered how long it could last. Remember Rule #1: it always takes longer than you think.

But now the chickens are home. They are roosting. I don’t know what the chickens ate but they are smelling particularly noxious. Even by chicken standards. Enrique Martínez-García at the Dallas Fed has been talking about housing and chickens coming home for some time now. His most recent report:

Skimming U.S. Housing Froth a Delicate, Daunting Task

U.S. house prices appreciated a remarkable 94.5 percent from first quarter 2013 to second quarter 2022—a 60.8 percent rise after adjusting for inflation. The magnitude of the increase is even larger than that of the preceding housing boom, from first quarter 1998 to second quarter 2007.

The real economy versus the just plain silly

This week equity markets wiggled and jiggled like a group of geriatrics at a senior’s only dance party: rigidly, within a very narrow range of motion, and petering out fairly quickly. Bond prices, however, were up and interest rates on the long bonds were down substantially. As a friend said to me after last week’s equity party: what the hell is wrong with the market? Dear reader, that is always a valid question and the usual answer is that I do not know. Recent bond market action perplexes my peasant brain. I did listen to a fantastic podcast with

who is the author of wherein he attempts to explain what the bond market is telling us. He makes a compelling case. What is a poor peasant to do but wince and grin and bear it all with good humor? Maybe bang out an essay complaining about it - a man yelling at chickens (forthcoming).Meanwhile people will go on and on about crypto kids fooling a lot of supposedly very smart people. They’ll tweet ad naseum about the coming Death of Twitter (still functioning at the time of this writing). We all type and opine endlessly about COP27 and the drivel that the Lords of the Manor spew in an effort to show off to each other. All of this is very entertaining and just great for selling newspapers (if newspapers really sold anymore). But is any of it real? Is any of it truly material to our economy? Did FTX or Twitter or any of the jokers at COP27 make real products that improve real people’s real lives in real ways? In a sense I guess they are as real as we make them. But when observed through the lens of what is really important (feeding people, housing people, making useful things that improve lives, ensuring the continuation of our species), it all seems just plain silly. Here’s something real:

Carthago delenda est. Also the Curve must revert

A very very long time ago in a place called Rome, Cato the Elder was a crabby old politician. And he hated the nation-state of Carthage with the fire of ten thousand suns. Old Cato ended every speech, no matter the subject of that speech, with the reminder that “Carthago delenda est", or Carthage must be destroyed. And one fine day Rome did destroy Carthage so I guess he got his point across. Way to stick to the message, Cato.

I’ve decided that I will take a page out of Cato’s book (he did write a best seller about Roman agriculture back when only 5 people could read) and be the gadfly of interest rate yield curves. Dear reader, repeat after me: The curve must revert! The curve must revert!! THE CURVE MUST REVERT!!! The current state of interest rates is not natural. It is flipped on its head. It is not a good thing when one sees a better return on a 1-year Treasury note than most commercial property cap rates. The curve must revert.

Now let’s see how long I have to keep this up - Cato died 3 years before Carthage was finally put to the sword which is not encouraging. It always takes longer than you think.

NAHB sentiment and the sound of flushing toilets

Narrative matters. How people feel about markets matters. Emotion and narrative drive markets and the real economy. As far as leading indicators for real estate, the NAHB sentiment surveys are canaries in the coal mine. That’s because home builders are at the tippity-tip of the housing and real estate spear. Their sentiment is based on conditions on the ground right now. Their business is chalk full of interest rate risk and market risk and supplier risk, etc, etc. They are the confluence of one of the biggest sectors of our economy. They must make projections regarding enormous sums of money months and years into the future. Guess what, folks? Home builder sentiment is floating in the toilet and ready to flush. If they feel this poorly about the economy, how will that translate into their long term decisions? I remain convinced that we are on the front edge of a very big storm. The housing industry employs tens of millions of people. The music is slowing, what happens when it stops?

Juuuust a bit outside: a story of stray missiles and the end of the world

Like Wild Thing pitching without his glasses, someone lobbed a couple of explosive projectiles a little too close to the Polish-Ukrainian border. The latest and greatest news is that the impacts that occurred inside Polish territory and killed two Polish citizens were the result of Ukrainian air defense firing Russian made missiles at Russian missiles aimed at Ukraine. Which is true. Probably. Maybe. Who knows? It’s just World War III so let’s not fuss on details. People were in a tizzy though and things were very tense for a hot minute.

The world’s 8 billionth baby award

After a morning of repairing water lines, I sat in my favorite eating establishment enjoying the world’s best enchiladas suizas when across the TV screen flashed the headline that the world’s 8 billionth baby is soon to be born. I chewed with delight and wondered just where do we fit all of these people? Then I realized that most of those people are on the highway during rush hour at the exact time that I need to be somewhere important. Whilst shoveling beans and rice into my face, I wondered what kind of prize one gets for being the 8th billionth baby. Does the baby get a scholarship or a blanket or a Yeti cooler? A nice button-up shirt with a big ‘8B’ embroidered on it? I’ll bet it’s something cool.

It is hard to fathom the number 8 billion. That is a lot of humans. Which is a lot of mouths to feed. Which makes me think that I need to buy some irrigated acres at the soonest opportunity.

What does it all mean for real estate?

Folks, let’s get real. The Fed has no good options. Raising interest rates was necessary. It was necessary a long time before they woke up and actually started to raise rates. They absolutely had to take the extra juice out of the system because things were getting out of hand and chickens were coming home to roost. But the destination to which they strive (2% inflation) is not achievable. The world is changing - it is rearranging. And the fundamentals of this world are inflationary far above a sublime, annual 2%. Because there are more people. And our resources (supply) are inherently constrained. And we must compete for them. And so they become more valuable. The most that we can hope for is a government that won’t get in the way as the situation works itself out. But that is a tall order and too much to ask. Because we are humans and addicted to the idea of control. We think we can get chickens to do as we want if we just yell a little bit.

The first problem with the Fed is that they look at the issue as a mathematical one instead of a human one. If X then Y. If I raise rates then markets will slow and unemployment will rise (or “the labor market will loosen”). But markets are people, not math. The economy is (soon to be) 8 billion humans and each with their own feelings and opinions - a vast sea of independent but related action. We are a dynamic chaos governed only by convention and basic human needs. Economics is our Culture of Exchange. We are a great flock of squawking chickens. And the eggheads forget this. Or are oblivious to it. Or ignore it. Probably all of the above.

And there is a second, hidden problem which I think might peak its beak up in the next year: people will only succumb to the tyranny of a formula for so long. How long will the Fed be able to hike before peasants with pitchforks start shouting for their heads? Because right now peasants are those whom Uncle Jerome is affecting most. This is not silly. It is very real. It is important. And the facts are just starting to show in the very laggy “averages”. How many and how long can one screw with homeowners and wanna-be homeowners before things go sideways? Homeowners vote folks. And whatever BS social issue is the flavor of the day, when the rubber meets the road homeowners will vote their wallets.

History shows that peasants are docile to a point. But once you cross the event horizon between docility and aggression, aggression metastasizes quickly. Say what you will about the ineptness of our politicians but at the very least they are each, red or blue, very sensitive to the feelings of the people. Neither want violence (if they are smart). I do not think it would take very much pain for the politicians (red and blue) to turn on the technocrats. It would not take very much squawking at all to convince the king to serve Uncle Jerome’s head on a platter. This could be the one thing that unites all of us together. Mr. Powell is not dumb. I suspect that he is also aware of this.

Dear reader, in the long term the fundamentals are inflationary: infinity wants in the face of very finite resources. BUT! We’ve a penance to pay first. In the real estate sector we are going to see recession and deflation (we are already seeing it) as Uncle Jerome fiddles with our money and interest rates. The chickens are home and real estate prices are going to suffer in the short term. Maybe for a year. Maybe more. Maybe less. It all depends on how much pain Jerome can inflict before we all punch him in the face repeatedly like Ralphie does to the bully in The Christmas Story. That said, I am ever wary of surprises and Dirty Larry knocking on the door and asking if we want to go out for the weekend (WW3 anyone?).

In the very shorty-short term, all things are relative and there is nothing like 7.3% interest rates to make 6.64% interest rates seem nice. If we continue to see a downward trend in rates in the next couple of weeks then we might even see a few properties sell. Which would be cool, man. Really cool. But with Fed interest rate increases inbound like stray missiles onto Polish farms, I do not feel it wise to bet said farm on rates coming down too much. Those waiting for a return to 3% mortgage rates are yelling at chickens. They should all hold their breath and deny that baby the 8th billionth person award. Which would probably be something cool like an engraved hunting knife or a year’s supply of beef jerky. Or maybe a new fishing boat or pickup truck…

Also important (probably)

What? What did I miss?

The world is a very big place and my vision is narrow. Help a fella out and tell me what I missed or how I got it wrong.

Texas Land This Week

The following information comes from LandWatch.com. (Please read the data disclaimer footnoted below1).

As of November 14, 2022 there were…

14,167 acreage properties listed as Available

Very slight increase over last week

0.55% increase over last month

964 acreage properties Under Contract

1 property up for auction

Five counties with the most listings:

Grayson County - Texoma Region (272 listings)

Edwards County - Edwards Plateau West Region (263 listings)

Henderson County - Piney Woods North Region (237 listings)

Hunt County - Dallas Prairie Region (232 listings)

Gillespie County - Highland Lakes Region (227 listings)

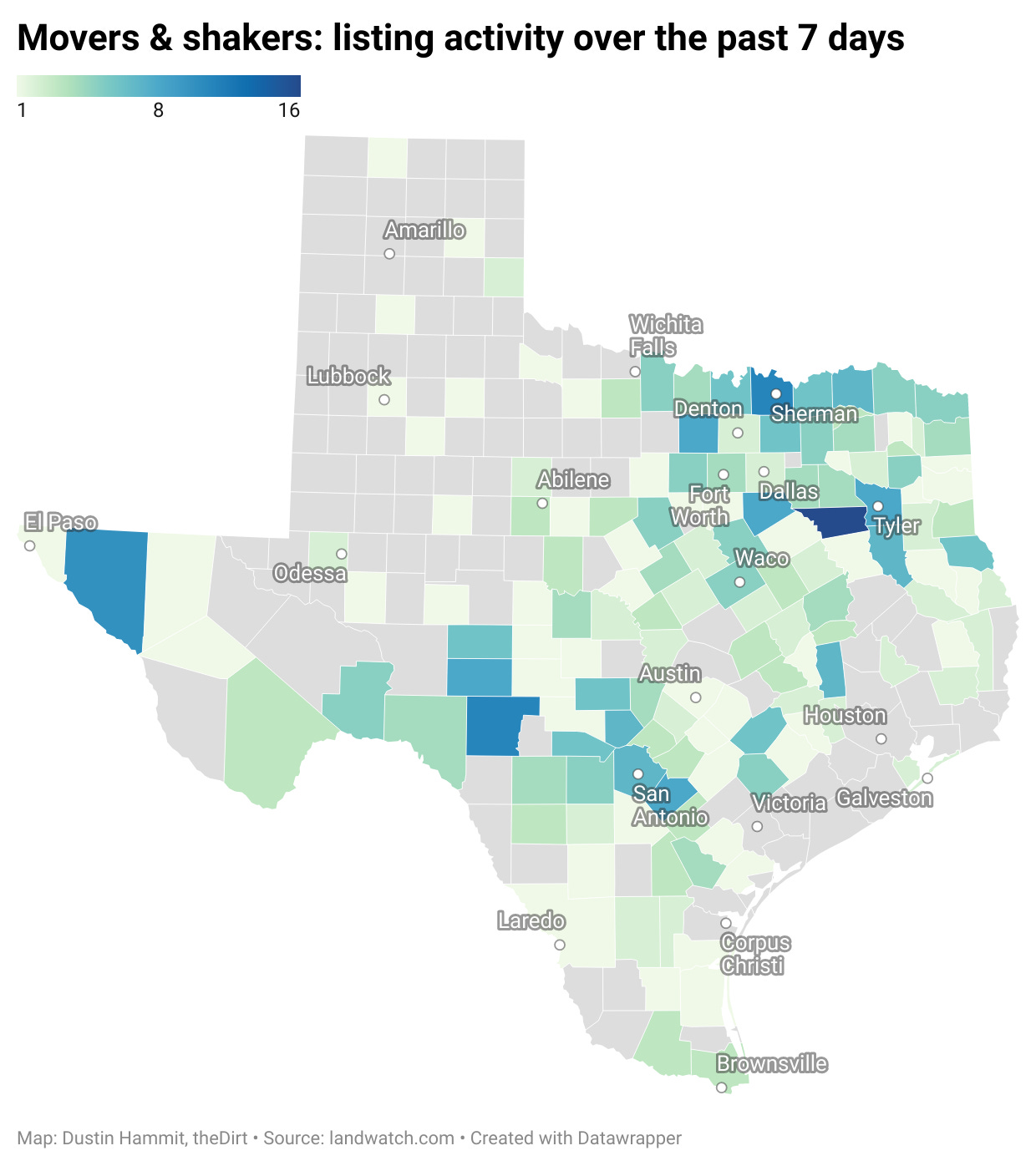

For the last 7 days there were…

437 properties listed or changed

10 properties marked as under contract

0 properties identified as Sold

Five counties with the most listing activity in the last 7 days:

Henderson County - Piney Woods North Region (16 listings)

Grayson County - Texoma Region (11 listings)

Edwards County - Edwards Plateau West Region (11 listings)

Hudspeth County - Trans Pecos Region (10 listings)

Wise County - Fort Worth Prairie Region (8 listings)

This image links to an interactive map.

Where I get my information:

An analyst’s analysis is only as good as the information they possess. As the old programming saying goes: garbage in-garbage out. The following is a list of my sources…

I follow a bunch of smart people on Twitter. A sample is represented above. I hope that you will also follow me on Twitter:

LandWatch.com and LandsofTexas.com

MarketWatch App (market quotes and data)

FRED: Federal Reserve Economic Data, Federal Reserve Bank of St. Louis

North Texas Real Estate Information System and Heartland Realtors

Houston Association of Realtors

The information is based on properties that are greater than 10 acres and which I refer to as ‘acreage properties’. This information is single source. Which means that this is NOT an exhaustive list of all properties available and sold everywhere in the Great State of Texas. Texas is a non-disclosure state and is therefore a Dark Market. This means that there are a great deal of data that are hidden, dispersed, not allowed to be shared publicly, or just plain unavailable. The following information is for reference and entertainment purposes only.