theDirt Weekly: Ordinary popular delusions and the March madness of crowds

March 18, 2023

If you can keep your head when all about you Are losing theirs and blaming it on you, If you can trust yourself when all men doubt you, But make allowance for their doubting too; If you can wait and not be tired by waiting, Or being lied about, don’t deal in lies, Or being hated, don’t give way to hating, And yet don’t look too good, nor talk too wise… -If by Rudyard Kipling

What an ordinary and sanguine week. Right? Right? Wait, what? What happened? Bank run? Seriously?

Before we go on, belated Happy St. Patrick’s day. The Irish in me honors the Irish in you. Now let’s dig in.

I mentioned briefly last week (by way of quoting another Substack) of the teetering-tottering of some west coast bank of which I’d never previously heard. Subsequent to publishing last week’s column, said bank fell off the wall and into the Bog of Eternal Stench. But, dear reader, don’t you worry a second about it because All the King’s Men came a riding to the rescue and promised to insure 100% of what appears to be rich techno-bro money (whether it was a bailout or not and whether this was the right thing to do - or not1 - depends a great deal on one’s perspective). Then the rest of the week happened. Brimstone. Fire. Wailing and gnashing of teeth. You know - the usual. And now there is a great deal of hand-wringing and national hyperventilating about where we are headed next. Well, there are plenty of guesses anyway. Some of them are generally correct. Almost all of them are precisely wrong. A lot more are just flat-out wrong. But we will only know which is which in hindsight. Good luck and may the odds be ever in your favor.

Fortunately, I am a real estate person. So even if I was inclined to panic, it would take me a long time to act on it. I feel for the financial-paper-people out there who, like Punxsutawney Phil, are trying to decide if that scary dark shape is their own shadow (or not). Of course, the safest play in these situations is to run back home and wait it out for another 6 weeks. And there are plenty who are doing exactly that. Which is a drag on markets of all flavors.

There are also plenty who don’t know whether to zig or to zag. In fact, watching the financial markets gyrate this week was like watching that squirrel on the road, trapped in indecision of which way to dart, wasting precious seconds, a large vehicle bearing down at about 65mph. Sorry little guy.

Anyway, for the writer and know-it-all, times like these are truly delicious fodder. Cue up the explanatory Twitter rants. The Substacks outlining the story in nauseous detail. And the general theorizing about why it all happened and what happens next. I’ve read about a billion of them. Which, and as is my wont, brings me back to the poetry of R. Kipling and, reaching back further still, to Charles Mackay and his 1840 smash-hit, Extraordinary Popular Delusions and the Madness of Crowds. After reviewing both I once again conclude that our popular delusions are really not that extra-ordinary at all. In fact they are, in the context of history, actually quite ordinary. We, Humans™ have been acting out the same play for thousands of years. This time is different, but it is not, etc.

What it all means for real estate…

If what I read is correct, it is all a simple matter of hydration. Which can be the only conclusion after encountering the word liquidity so often in a single day. So we all just need to drink some water. Coincidentally, ‘drink water’ is my prescription for all medical ailments, from stubbed toe to diarrhea to sub-dermal hematoma. So I think it should work here too.

I found this read to be the most succinct and accurate explanation of our current monetary dilemma:

Death of QTNo but seriously - the real problem is the amount of cash money that banks have or do not have. Or will have. Or should have. Or at least will have if they can just get that one last extra extra infusion of liquidity.

There is also the panic of people panicking and the banks trying to entice them not to panic and withdraw their money which only increases the panic. Those in the know might call this a positive feedback loop (‘positive’ as in increasing, not ‘positive’ as in something good). And now we have this deal where some banks are big and important and the .govs (pronounced DOT-guvs) have their back and they’re gonna be okay no matter what. And then there are the other banks who are small and unimportant and seemingly on their own. The problem for the Dirty and Nerdy is that when it comes to real estate, especially commercial real estate, these small regional banks are where the business is at. I found this tweet to be enlightening…

Also this…

Which is something that I knew in the back of my mind but hadn’t really considered until waved right in front of my eyes. Not unlike genetically-gifted, fence-hopping calves (from last week’s column), after the fact I think: oh yeah, this could be a problem. In an equation with a billion variables this kind of lapse is bound to happen from time to time and pretty much explains our inability to predict much less control. Let’s call it the ‘whoa-I-never-saw-that-one-coming-but-should-have’ phenomenon. Like when a pawn moves forward and my queen is taken because I totally wasn’t paying attention! The bureaucrats in charge are highly visible examples of this.

In the real estate world, liquidity issues and the stability of the smaller banks are where the panicky squeals originate. Because folks, if the loans stop coming then the real estate markets (and all markets really) stop pumping. We are a credit driven economy. Right or wrong or whatever, the reality is: No credit, No economy. Even in rural land where around 60% of deals are cash deals, an immediate halt in the other 40% of levered deals will tank markets.

And so, in what has effectively become our centrally planned economy, all eyes now turn to guessing just what the hell the Fed and FDIC and Treasury, etc (All the King’s Horses Asses) are going to do now. They are boxed in. In a tight spot. Rock and hard place and such. Next week could be an interesting week. Of course my guess is they adjust their definition of what is considered acceptable inflation, turn the spigot back on, and try their best to walk the inflationary tightrope. The other option is the seized engine of commerce that results when you forget to add oil. Po-TAY-to, po-TAH-to.

But whatever, I’ve got cedar to clear.

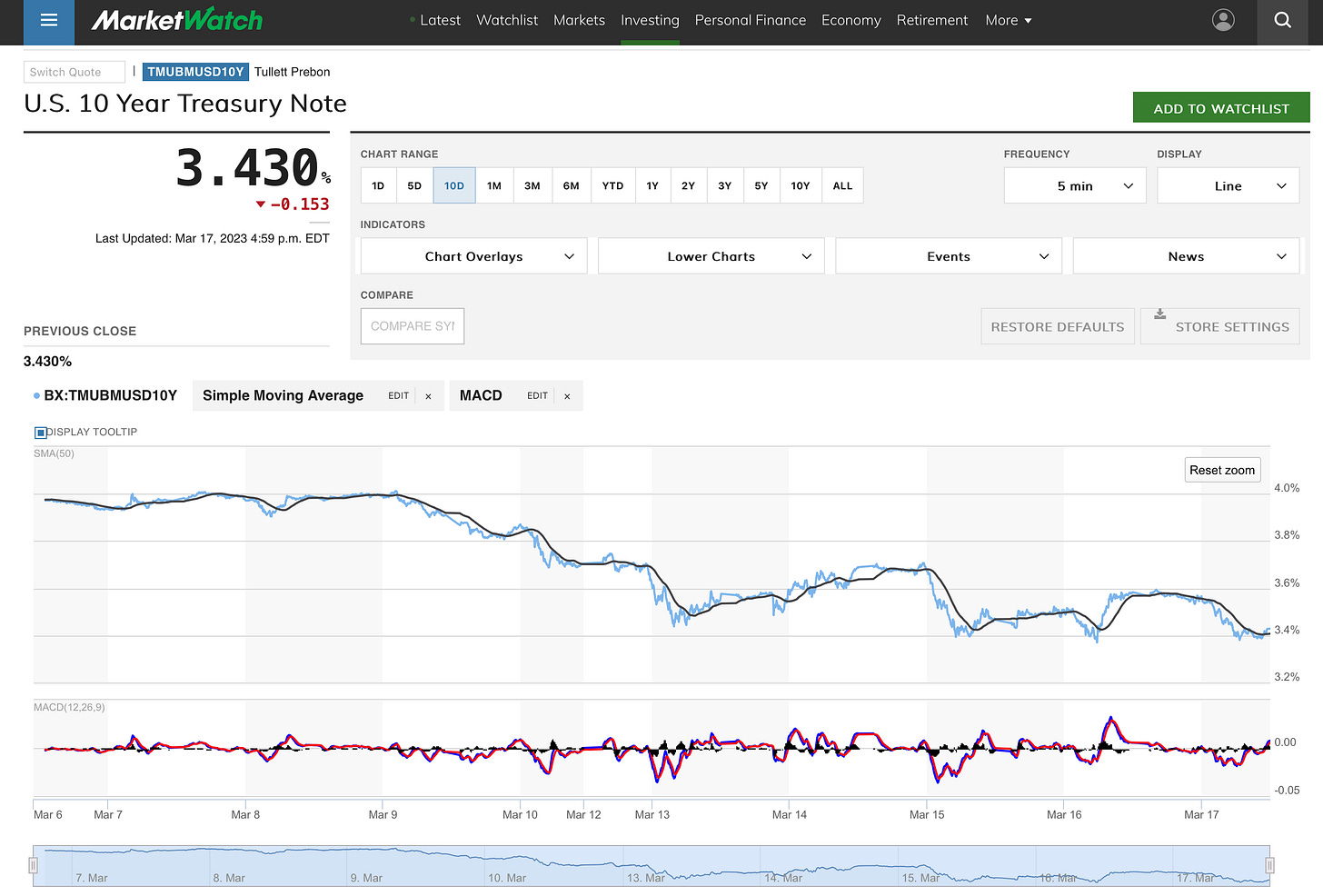

The curve is still inverted

For a hot minute it seemed like maybe, just maybe, the poo had hit the fan and rates might revert. But no. Not this week. Maybe next week. But probably not.

It was a crazy week for rates though.

Coda: be the skeptic

I’ve found that after absenting myself from the noise for a few days, I really only have to spend about an hour reading to get fully caught up. Which makes me wonder how people do this all day long. But anyways… I found that in the context of the phrase ‘bank run’ and all the fear and panic underlying it, there were two pieces which really stuck out:

Douglas Boneparth: Screaming "Bank run!" in a crowded Twitter

The thing about panic and delusions and whatnot is that they are not too unlike a very nasty and infectious virus (we are all virologists these days) wherein the disease travels very quickly from one person to another. Dear reader, fear is a contagion. It is a highly transmissible and efficient one. Dwelling on the like, Your Humble Author’s thoughts then devolve into the introspective philosophical: namely - as one of the many faceless noises in a sea of noisy faces, what part am I playing in all of it. What part am I playing in spreading the virus. I hope to be a voice of reason. We’ll see.

I worry about such because the author of the Extraordinary Popular Delusions book noted above, Charles Mackay, was himself a glib partaker in the mania of his era: railroads. Which is to say that he himself, as a journalist and widely read voice of his day, was a contributor to the delusion of which he later wrote so vociferously about.

Which then led my twisted little brain back to this picture:

For those who’ve not seen it before, this is a picture of August Landmesser refusing to perform the Nazi salute at a Nazi rally in 1938. That, dear reader, is what the potty-mouthed cowboy might call cajones. Great big ones. It is notably difficult, even for the true skeptic, to stand apart from the herd. And it is made still more difficult knowing that the herd might pummel you for standing against it.

Fortunately, dear reader, neither you nor I are standing within the mania of a Nazi rally. We are also not in the mania of the dynamic Weimar hyper-inflation which preceded it (and arguably allowed the Nazi party to gain foothold into power in the first place). No, dear reader, we are in the midst of a hum-drum global financial panic attack. If it is really even that. Coming off a week of camping and beaching and getting Dirty (placing feet firmly in the Dirty real), my take is that we are, as yet, merely in a state of goth-emo, dollar-denominated monetary ennui. Given the velocity of news and rumor and fear these days (thanks internet and social media), this might even be the world’s first flash-panic. Just a touch of national anxiety. Nothing a little Xanax and FDIC insurance can’t cure.

Or maybe not. Maybe this is the big one. Snark aside, I’ve no clue what the future holds. If there is one place where it is completely acceptable to be completely ignorant, it is in the midst of a Dirty dark backwoods road with no light, no map, nor a compass to guide you. And this, I am convinced, is precisely where we all are. And in lieu of sobbing and crying for my mommy, I try only to stand fast, to breath slowly and deeply, to gain my bearing, and to don my best August Landmesser impression: arms crossed with a healthy dose of skepticism on my face while the world loses its mind around me. The good news is that I have a great prescription for what ails us: get Dirty and drink water. I find both are better than benzos and free money anyway.

Siri, define ‘moral hazard’